WVPA LEGISLATIVE ALERT:

CHARLESTON, W.Va. — House Bill 2704 — now before the West Virginia House of Delegates — represents a series of new taxes with a “pyramiding effect” that will stop potential business and industry growth, kill existing small businesses and force remaining businesses out of the state.

Monday, West Virginia’s House of Delegates is considering on second reading HB 2704, which could be the largest tax increase placed on West Virginians in decades. This bill places new taxes on professional services that West Virginia businesses and residents need and use everyday.

HB 2704 would add a new 5.5 percent tax to a wide array of services from the cost of each hair cut, every beauty salon appointment, lawyer visits, tax preparation and veterinarian visits.

Worse yet, the new professional service tax proposal has a “pyramid effect” that not only places a new sales tax on the services but has the potential to increase the actual cost of every item sold in West Virginia by adding the new 5.5 percent tax at each level of production.

As an example: West Virginia could soon be the home of the $30 hamburger as the pyramid of taxes will force small businesses such as family restaurants to increase prices to cover the cost of numerous new taxes. Mom and Pop must now pay this new 5.5 percent tax on each accounting bill, on each attorney bill, on each janitorial service visit and for each lunch special they advertise for customers and residents. The taxes increase – or pyramid – for every professional service the restaurant uses. Mom and Pop will have no choice but to pass the cost of the new taxes on their customers. The result: a $30 hamburger.

The bill was approved by the House Finance Committee and championed by Finance Committee Chairman Eric Nelson, R-Kanawha, and Finance Committee Vice-Chairman Eric Householder, R-Berkeley. The sweeping new tax legislation was a surprise presentation as a strike-and-insert change to HB 2704 during Saturday morning’s House Finance Committee meeting and sent to the House for a first reading later that day.

The Finance Committee’s changes to the original HB 2704 took the bill from three to 30 pages. Nelson and Householder cite a drop in the overall consumer sales tax from 6 percent to 5.5 percent as the benefit of the bill. Unfortunately, the impact of their plan will cost residents significantly more than the current tax structure or the 1 percent increase in the consumer sales tax proposed in the original bill.

Nelson and Householder’s House Bill 2704 — at a projected $344 million tax increase — looks to be the largest tax increase since Gov. Gaston Caperton’s tax increase plan in 1989. HB 2704 will cost customers money at the cash register, reduce sales and, as a result of its overall negative impact, do nothing to help the state’s budget issues.

The impact of HB 2704:

The majority of professional services taxes in HB 2704 are business-to-business transactions. These are expenses that increase the cost of production and will be passed on to the consumer. There are a number of tax policy reasons why these sales should not be taxed:

— Sales taxes on professional services are particularly harmful to the small business, which must raise prices on products to pay the tax HB 2704 places on necessary services. Faced with paying a 5.5 percent tax for all accounting services, all attorney services, each improvement investment with a contractor and each advertising investment with a media source, West Virginia small businesses will either raise prices to an uncompetitive level, fall out of compliance with state code, or close their doors. HB 2704 will kill small business.

— The consumer sales tax is designed to be a tax on consumption, but when business-to-business services are taxed, it becomes a tax on production. Taxing business-to-business transactions results in highly inefficient tax pyramiding as multiple layers of taxes are applied to the same end product. Economists uniformly view this as bad policy. HB 2704 will result in higher costs.

— HB 2704’s proposed reduction in consumer sales tax would not generate a savings, being offset by the higher price for all products. There is no tax break for the consumer in this plan. Cutting the 6 percent consumer sales tax to 5.5 percent on a $10 item reduces the cost five cents from $10.60 to $10.55 for the item. Once a business increases costs to cover this tax on services such as advertising, accounting, legal and janitorial services, and other now taxable services, that $10 item could easily cost the consumer more than $11. HB 2704 will hurt West Virginia residents.

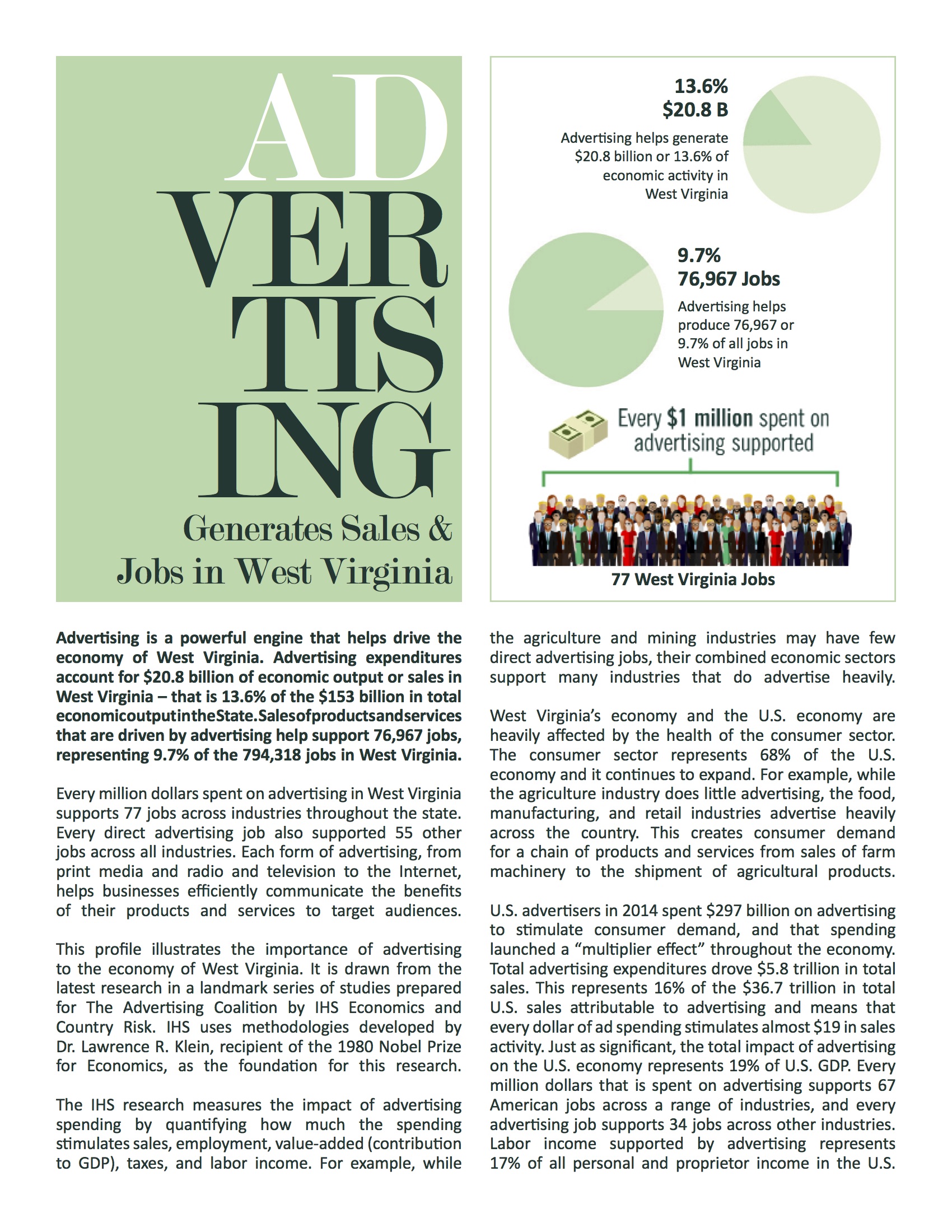

— Advertising, specifically, is an investment to increase sales, and HB 2704’s efforts to tax that investment would result in fewer dollars being available to a business for the promotion of their products and services. No state in the United States currently applies a sales tax to advertising. Less advertising would result in less business, less profitability and result in loss of jobs. A decline in sales of products and services would offset any suggested tax increase from HB 2704. HB 2704 will reduce sales.

— Large businesses can, in many cases, choose to use out of state offices and services such as law and accounting firms to service their needs. Would the Health Plan of the Ohio Valley have announced a move to West Virginia had they known it would mean higher business costs? Many companies will have the delivery of those services arranged so as to result in the “sale” being sourced to another state for sales tax purposes. HB 2704 puts West Virginia businesses at a disadvantage.

— Taxes on professional services impede overall economic development and put the state at a competitive disadvantage, especially with professional services firms that operate in a state without such taxes – which is most states. What companies will move to West Virginia with this new business-to-business tax burden? Worse yet, every county and city along the border can expect businesses to migrate to the neighboring state. HB 2704 will move businesses out of West Virginia.

— The “delivery” of professional services in many cases can be manipulated to occur outside of West Virginia and thus would result in widespread avoidance of the tax by large companies. HB 2707 will reduce actual overall tax revenue.

The West Virginia Press Association opposes HB 2704. It’s bad for businesses, bad for the state and bad for the residents of West Virginia.

In terms of advertising, this flawed bill will impose a nearly 5.5 % tax on small businesses throughout West Virginia that rely on advertising to reach their consumers. The proposed tax will destroy more small businesses and will make Main Street a ghost town in many West Virginia communities.

Small businesses are a key part of the West Virginia economy. From the family owned and operated car dealership in Beckley, to the family law firm in Moorefield, to the accounting firm in Wheeling, small businesses rely on advertising to drive sales. Simply put, less advertising will mean less sales and the loss of jobs and businesses. A tax on advertising will mean that for every $100 dollars spent on advertising, $5.50 will now go to the government. A tax on advertising will devastate small businesses that are already struggling to grow in West Virginia.

There is substantial evidence to cast doubt on the fiscal effectiveness of HB 2704. West Virginia is not the first state to attempt to broaden its sales tax base.

In April 1987 the Florida legislature passed a bill extending the state’s five percent state sales tax to an array of new services and repealed exemptions for many previously exempt services. After the bill’s passage, the legislature was forced to postpone the tax’s enactment until July 1, 1987, citing “significant policy, revenue, legal and administrative implications” that required further consideration. Six months later, in December 1987, the new sales tax was repealed.

Here’s what happened:

— Businesses hated it. National advertisers such as Coca-Cola, General Foods and Procter & Gamble terminated or reduced advertising efforts in the state, resulting in a $100 million reduction in advertising revenue, and some businesses helped fund taxpayer efforts to have the tax repealed. Businesses had difficulty determining what services the new sales tax covered and were confused about how to account for the tax. Further, businesses argued that the cost of the sales tax would be passed down to consumers.

— Taxpayers did not support it. Seniors worried that the sales tax would extend to medical care services, and local groups organized to oppose the tax.

— The new sales tax on services was repealed just six months after its enactment.

The WVPA urges all delegates to oppose HB 2704. West Virginia businesses can’t afford a greater tax burden.