By FRED PACE

The Herald-Dispatch

HUNTINGTON, W.Va. — Kent Queen, vice president of Kenny Queen Hardware, says he supports national tax reform, but he doesn’t have many of the details to understand the impacts it could have on him and his business.

“I am interested in learning more about the details of the Tax Cuts & Jobs Act,” Queen said. “We have 75 employees at three locations in the Tri-State area, and I want to learn about what impact it will have on the business, as well as on our employees.”

On Monday, a discussion on tax reform was hosted by U.S. Rep. Evan Jenkins, R-W.Va., with the help of the Huntington Regional Chamber of Commerce.

Monday’s event was aimed at gathering input for the tax relief proposal that will be presented to Congress in the coming weeks. Tax relief and simplification, long talked about throughout the United States, is one of the platform issues championed by President Donald Trump.

“This is the first time since 1986 that we have had real, meaningful tax reform,” Jenkins said. “It’s tax cuts for middle class West Virginians and Americans, it’s helping small businesses grow because we know that’s where the jobs are, in small business.”

Under today’s tax code, small businesses are taxed at the same individual rates as wages, making it more difficult for job creators to grow and create jobs, according to Jenkins.

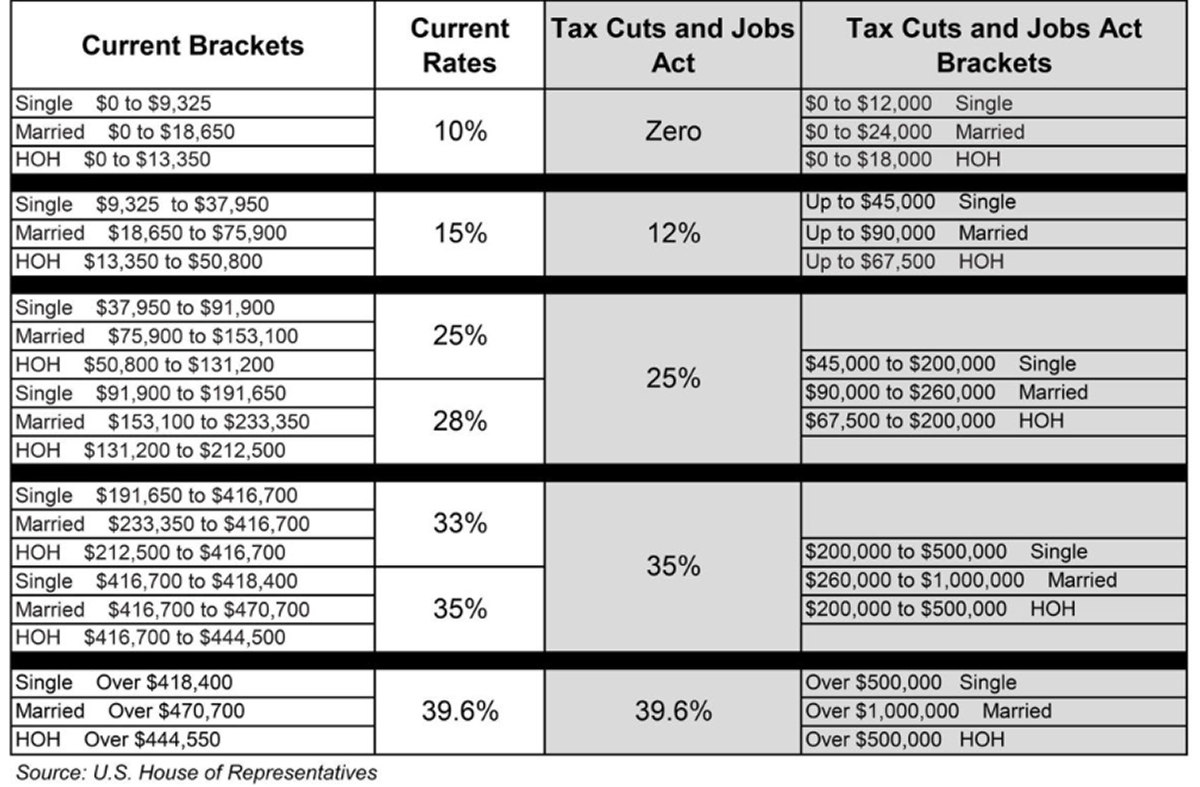

“The Tax Cuts and Jobs Act delivers a new, low tax rate for small businesses of no more than 25 percent, the lowest rate on small business income since before World War II,” he said.

Information distributed by Jenkins also showed the legislation distinguishes wage income from pass-through business income.

“This means, for example, that the small business income of ‘Tom’s Bike Shop’ will no longer be subject to the same tax rates as the personal wage income of NFL quarterback Tom Brady,” the report said. “With this fairer and less costly tax system for our Main Street job creators, they will be able to keep more of their earnings to grow their businesses, hire more workers and increase paychecks.”

Jenkins said feedback he has received from both businesses and individuals is mostly about simplifying tax filings and rates.

“The idea that we can actually file our tax return for 9 out of 10 people on a postcard is an important step, but I wanted to make sure I hear from the people of the Third Congressional District on the impact of this tax reform, and what their ideas are and how can we make it is bold, a big and strong as possible.”

Jenkins said the current tax code is very complicated.

“A lot of people have been able to look for the silos of tax credits, deductions and loopholes over the last couple of decades,” he explained. “Some are concerned as we eliminate a lot of the deductions, loopholes and tax credits while reducing the rates for everybody, people want to know how does this impact me or my business. This is the right question to be asking, so that’s we are out to share the information and listening for feedback.”

Also the corporate tax rate, currently the world’s highest at more than 30 percent, would be reduced to 20 percent. That, say proponents of tax reform, would provide incentive for companies to do business in the United States.

Jenkins emphasized that a reduction in tax rates for people and businesses would lead to increased economic growth.

“The Tax Cuts and Jobs Act delivers tax relief at every income level, while maintaining the top 39.6 tax rate on high-income earners,” Jenkins said. “It brings down the rates and makes sure hard working taxpayers and small businesses keep more of their money in their pocket.”

Bill Bissett, president and CEO of the Huntington Regional Chamber of Commerce, says when it comes to tax reform, the critical information businesses and individuals want to know about is in the details.

“That’s what is good about this event,” he said. “We get to hear directly from our Congressman, who is directly in the center of this issue, and find out what it means to them and what impacts it would have on them. I think everyone wants to see a more simplified process for filing taxes.”

Follow reporter Fred Pace at Facebook.com/FredPaceHD and via Twitter @FredPaceHD.

See more from The Herald-Dispatch