By RUSTY MARKS

The State Journal

CHARLESTON, W.Va. — West Virginia Gov. Jim Justice said state tax officials and those running several of his coal companies are close to reaching an agreement on millions of dollars in past-due severance and other taxes.

“I’m a high-profile guy now,” Justice said Aug. 4, a day after announcing with president Donald Trump in Huntington that he would change his party affiliation from Democrat to Republican. “It needs to be straightened up.”

Justice has made it clear he has turned over operations of his coal interests to his son, Jay Justice, but millions of dollars in severance taxes remain unpaid.

A review of tax documents shows several Justice-owned companies still owe back taxes both in Raleigh and Kanawha counties.

According to tax liens on file in the office of the Raleigh County Clerk, Justice’s companies owe almost $2.27 million in back taxes and penalties in Raleigh County. The taxes are owed by Southern Coal Corp., Kentucky Fuel Corp., Justice Energy Co. and Tams Management Inc., all owned by Justice.

Between August 2016 and February 2017, state officials also filed tax liens totaling almost $972,000 against Tams Management in the Kanawha County Clerk’s office. The liens are in addition to about $1.22 million in tax liens filed against Tams Management in Kanawha County in 2013.

According to Kanawha County tax records, Justice owes at least $2.89 million in back taxes in Kanawha County.

Justice said in July that some of the taxes owed by his companies are in dispute. “As soon as it’s worked out, every single last penny of every bit of it will be paid,” Justice said in an article distributed by the Associated Press.

Justice said the dispute is not over whether his companies owe the taxes, but in the amounts that are owed. He said his knowledge of the back taxes is based on what he has been told by Jay Justice, but he believes company executives and tax officials are close to coming to an agreement on how much needs to be paid.

Some of Justice’s past-due tax bills have been paid. In June 2016, documents on file in the Raleigh County Clerk’s office showed that the state released a lien against Justice Energy Co. after the company paid off about $1,200 in back taxes.

A lien against Tams Management for about $84,000 filed in Kanawha County also was released after the debt was paid off, Kanawha County Clerk’s records show. Another lien against Tams Management for $133,380 was released in July 2016.

Keeping track of who has and hasn’t paid state business taxes falls to the state Tax Department.

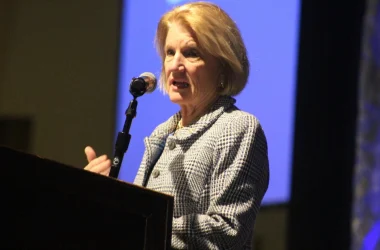

“Everybody thinks that we can do that, but that isn’t true,” said Kanawha County Clerk Vera McCormick.

Officials say the main remedy to address business owners who have not paid taxes is to file a tax lien against their property.

See more from The State Journal