CHARLESTON, W.Va. — The biggest name in the West Virginia’s workers’ compensation market keeps getting bigger. And as far as BrickStreet Mutual Insurance CEO Greg Burton is concerned, that won’t be stopping any time soon.

CHARLESTON, W.Va. — The biggest name in the West Virginia’s workers’ compensation market keeps getting bigger. And as far as BrickStreet Mutual Insurance CEO Greg Burton is concerned, that won’t be stopping any time soon.

“I’m sure that there are other carriers that are in the marketplace that continue to try and take some of our business,” Burton said. “But we want to continue to be the dominant carrier in West Virginia, given that we’re domiciled here, and continue to work as hard as we can to get as much business as we can.”

BrickStreet, the Charleston-based company which was the first private company to offer workers’ compensation in the state, officially announced a joint venture with Motorists Mutual, expected to close in July. The partnership will allow BrickStreet to manage nearly $60 million of workers’ compensation business from Motorists and access to other lines of commercial insurance.

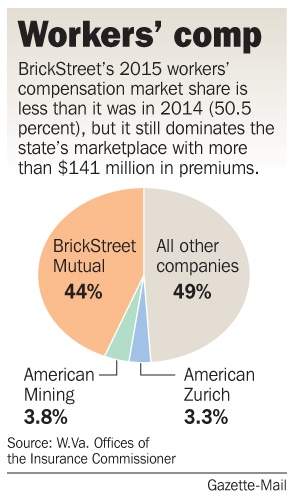

The company already has a vice grip in workers’ compensation with nearly 44 percent of the state’s market share in 2015 and more than $141 million in premiums, according to the West Virginia Office of the Insurance Commissioner’s annual report released Tuesday. In second place is American Mining Insurance with 3.8 percent market share.

That doesn’t even include SummitPoint Insurance, a BrickStreet expansion company with 2.24 percent of the market share. State Insurance Commissioner Michael Riley said it’s an indicator of the strength of BrickStreet’s business model in satisfying current policyholders.

“I think a lot of credit goes to BrickStreet,” he said. “But at the same time, there has been a lot of other carriers that are providing choices and options for people. I think [BrickStreet] will probably lose some market share through the years, but it certainly hasn’t been significant.”

The share is still a much larger figure than neighboring Pennsylvania has seen. In its insurance department’s July 2012-June 2013 annual report, the most recently available, the State Workers Insurance Fund led with a 7.59 percent market share, and Zurich American Insurance came in second with 3.47 percent market share.

BrickStreet is in a unique position compared to most companies in its lines of business, however. It used to be the only option for West Virginians when it was created and implemented at the beginning of 2006 as a response to the deficits of the state-run workers’ compensation program spiraling out of control with coal companies not paying their premiums.

The state’s program faced unfunded liabilities of more than $3 billion and was losing $1 million a day, according to Burton, who was a part of the Workers’ Compensation Commission created to review the system in 2003. Two years later, former Gov. Joe Manchin signed into law the bill moving West Virginia from a state-run system to a private system run by BrickStreet.

In July 2008, the state opened the market for other companies to join in. Since then, BrickStreet’s market share has dropped from virtually the entire pie to less than 50 percent.

“Rates are down about 65 to 70 percent since Jan. 1 of 2006,” Burton said. “That’s more money that employers can use to hire employees, buy new equipment and expand their operations. From a workers’ compensation standpoint, I think the system is in a lot better shape than it was.”

“It’s actually had a pretty dramatic impact on premiums in the state,” Benedict said. “If you look at everything since they went private, the cumulative loss costs decrease has been 69 percent, which is pretty significant.”

Net written premium – the sum of all premiums a company may collect – has also dropped, at least for BrickStreet. The company’s net written premium for 2015 was $260.6 million, its lowest since 2011. Burton chalks it up to sharp rate decreases across the board, along with the state of the coal mining industry.

“In our state, as well as in other states, coal mining is down, so just by nature we’re going to lose those top-line premiums,” Burton said. “But I think if you look, it’s still possible to make money and for us to put money into our surplus.”

But Burton said the company’s premium should improve with the recent acquisition of the Pittsburgh-based HM Insurance Group workers’ compensation policies and accounts, which totals roughly $120 million in premium.

The partnership with Motorists Insurance certainly won’t hurt, either. Todd Long, a company spokesperson with Motorists, said the joint venture will allow BrickStreet to expand into other markets while maintaining its West Virginia roots, an advantage over a merger.

“The beauty of the affiliation allows them to maintain their local business,” Long said. “It gives you the resources of a national organization, but you still have the presence to do business in your own backyard.”

BrickStreet will have the tools by next year to expand to several additional lines of insurance while still maintaining its headquarters in Charleston, pending approval by state insurance commission. Company agents will have access to Motorists’ lines, which include property and casualty insurance.

The new partnership would create a super-regional carrier with nearly $1.2 billion in premiums. Burton would become the executive chairman of the venture and Motorists President and CEO Dave Kaufman would become CEO of the joint venture.

“There’s no reason I can think of that [the joint venture] would not be approved, because it’s good for both companies,” Long said. “Together we’d be able to offer a wide variety of products.”

Reach Max Garland at [email protected], 304-348-4886 or follow @maxgarlandtypes on Twitter.