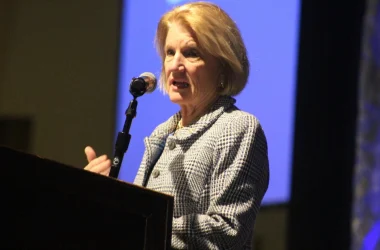

Kin Sayre, attorney for the City of Martinsburg and a member of the state Home Rule Board, was the guest speaker of the Chamber of Commerce’s Rise and Shine Breakfast Friday to talk about the 1 percent sales tax the city will begin collecting on July 1.

MARTINSBURG, W.Va. — Kin Sayre, attorney for the City of Martinsburg, doubts if most people are willing to drive outside the city to save 1 cent on $1 after the city starts assessing a 1 percent sales tax on July 1.

“The facts and figures don’t support that,” Sayre said. “It’s like the gas tax. When I’m driving south, I make sure I have enough gas to get to the Flying J (in Virginia), and I fill up, but I don’t drive to the Flying J from Martinsburg to get gas. It would cost me more than I would save. It doesn’t pay.”

Sayre was the featured speaker Friday at the Martinsburg-Berkeley County Chamber of Commerce’s Rise and Shine Breakfast. He gave an overview of the municipal sales tax that Martinsburg, Ranson, Charles Town and several other cities across West Virginia were given the authority to collect by the West Virginia Municipal Home Rule Pilot Program Phase II.

Sayre also is a member of the Municipal Home Rule Board, which oversees the Home Rule program.

Sayre cited Huntington, one of the original four Home Rule cities in the first phase of the program, as an example of how imposing a 1 percent sales tax did not drive shoppers out of the city to a mall in nearby Barboursville, which is named the Huntington Mall Shopping Center. He said sales actually went up in Huntington, which was probably helped by a better economy generally. Also, sales apparently went up at the Barboursville mall as well, because of the economy, he said.

As part of the legislation enabling cities to assess up to a 1 percent sales tax, cities had to eliminate or reduce their business and occupation tax. Martinsburg City Council members chose to eliminate the B&O tax on amusement businesses and reduce the B&O tax by 10 percent on retail and wholesale businesses.

“Cities have complained that the B&O tax was stopping them from growing,” Sayre said. “It’s a tax on gross receipts. People hate that tax.”

However, retailers get upset when they think they have to pay a sales tax, Sayre said.

“They don’t pay the sales tax – customers pay the sales tax,” he said. “Retailers just collect and remit the tax to the state. The B&O tax comes out of retailers’ pockets. They appreciate the change from B&O taxes to sales taxes when they understand that.”

Sayre said there are more than 60 exemptions to the sales tax. Some are simple and some are complicated, he said. He recommended going to www.bowlesrice.com/penny.html to download the West Virginia tax rate chart and additional tax information. Sayre is a partner in the Bowles Rice law firm.

Generally speaking, municipal sales taxes will be applicable to anything upon which the state assesses a sales tax, Sayre said, and are not applicable to sales the state does not tax, such as professional and personal services.

After the state gets the tax revenues from businesses, it can keep up to 5 percent for administrative purposes, according to the Home Rule legislation. The balance will be distributed to the cities probably on a quarterly basis, Sayre said.

The city estimates it will receive about $2.4 million annually from the sales tax. It will lose about $300,000 in the eliminated and reduced B&O taxes.

Martinsburg has set up a separate fund for its sales tax revenues. The revenues will not go into the general fund. That way, the city can finance bonds with the sales tax revenues, Sayre explained.

City Manager Mark Baldwin, who also was at the Chamber breakfast, said the revenue from the sales tax would be used for infrastructure improvements and permanent capital improvements. The revenue also could be used for a city economic development program, but not for ongoing expenses, he said.

Baldwin emphasized that businesses in Martinsburg, especially retailers, need to be aware that the software on their cash registers will need to be updated to charge the additional 1 percent sales tax beginning July 1, so they do not get caught with a tax liability.

– Staff writer John McVey can be reached at 304-263-3381, ext. 128.