Records indicate one third may miss deadline, face fees

CHARLESTON, W.Va. — The deadline for West Virginia businesses to file annual reports with the Secretary of State’s office is June 30, but records indicate about a third of those businesses may miss the deadline and face late fees.

West Virginia Secretary of State Natalie Tennant said her office will stay open late on June 30, the deadline for businesses to file annual reports.

Natalie Tennant

“We want folks to know June 30 is the deadline and we want them to meet the deadline and not have to pay a late fee,” Tennant said. “We’ll be open late on June 30, probably until about 7 o’clock.”

There are about 95,000 for-profit and not-for-profit corporations and limited liability companies in West Virginia. Each is required to pay a $25 annual fee and file an annual report between Jan. 1 and June 30 with Tennant’s office. Sole proprietors are not required to file annual reports.

The reports filed with Tennant include a list of the company’s officers, the address the company uses for legal correspondence and the address where business is conducted. The reports do not contain financial information.

About 30,000 businesses typically fail to meet the deadline, said Tennant spokesman Jake Glance. Most of the tardy filers pay a late fee, complete the required paperwork by Oct. 31 and return to good standing.

Tennant noted that the late fee has been lowered from $100 to $50 for for-profit companies and $25 for nonprofit entities.

Even so, 4,000 to 5,000 businesses typically don’t comply by Oct. 31 and are administratively dissolved, Glance said. About 2,000 of those eventually pay the late fee and a $25 reinstatement fee and get back into compliance.

Glance said the top reasons businesses fail to file on time are: The business changed its address and failed to notify the Secretary of State’s office so it didn’t receive the reminder that is sent out every January; the business has closed, or the business has new officers who were not informed of the filing requirement.

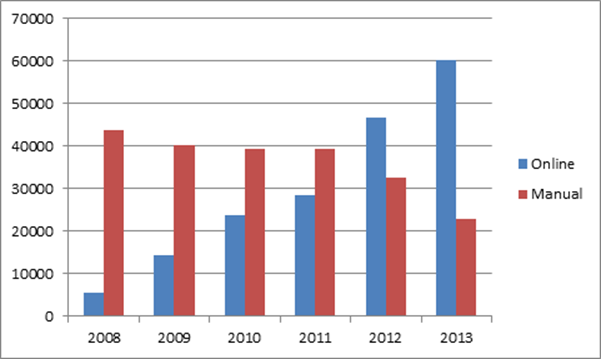

The easiest way to file an annual report is through the state’s online portal, www.business4wv.com. More than 72 percent of all annual reports filed last year were filed online.

“We are really proud of these numbers that have increased over the last six years,” Tennant said. “We’ve been promoting this a lot more; we have streamlined it even more. We have made it easier for folks to be able to do a majority of their work online.”

Tennant is a former broadcast journalist and co-owns a media company with her husband. She said that as a small business owner, she wanted to make filings easy. “I knew we had this ability for online filings so we started promoting it. The approach for me to this was, ‘How can we make it easier for businesses to be able to focus on their product and not their paperwork? How can we save them time and money that they can use to grow the business and hire more people?’

“I always say that one of the perks of owning a small business is you get to work nights and weekends,” she joked. “So when you’re working at night and you have to do some work with the Secretary of State’s office, we make it very efficient to be able to go online and get a Certificate of Existence or Certificate of Authorization that shows you’re in good standing if you need to give that to an entity or a bank. That is so important because 96 percent of our economy is run by small businesses.”

During office hours, businesses can quickly get answers to questions by using Online Help Chat. Tennant gave this example of how the service can be used:

“A flower shop owner in Tucker County, while tending to a customer, can ask a quick question without having to be on the phone with the Secretary of State’s office. We respond and you don’t have to wait on the phone — you can do other things. Small businesses folks in West Virginia are multi-taskers. That’s why this is a great feature for them.

“It has grown in popularity,” Tennant said of the service. “We started it from 9 a.m. to 11 a.m. and 2 p.m. to 4 p.m. Monday through Friday. Then we went from 9 a.m. to 4:30 p.m. We’ve had more than 5,500 chats with people” since the service became available in December 2011.

Most chat users have start-up questions. Glance said some questions don’t relate to the Secretary of State’s Office “but the staff finds the correct contact and guides them to the right place.”

The Secretary of State’s office is one of several that require business filings.

Anyone conducting any kind of business in West Virginia must register with the state Tax Department prior to starting operations. The registration is permanent.

Deputy State Tax Commissioner Kristin Mounts said the Tax Department does not require annual reports. However most businesses interact often with the department because it administers several widely collected taxes, including sales tax and withholding taxes, and numerous industry-specific taxes.

Municipal sales taxes are the latest addition to the tax collecting and reporting requirements. Williamstown, Huntington, Rupert, Harrisville, Wheeling, Quinwood and Charleston currently charge sales tax. Fifteen additional cities want to impose a sales tax if they are accepted into the state’s Home Rule Pilot Program.

Businesses collect municipal sales taxes and remit the money to the state Tax Department monthly, quarterly or annually, depending on the amount. The department distributes the money.

Mounts said it is incumbent upon businesses that deliver goods or perform services in communities with a municipal sales tax to make sure they collect and remit the tax. “Businesses are going to need to be cognizant of this and call us with any questions,” she said. The phone number is 1-800-982-8297.

Click here for helpful tax websites

Municipal sales tax rates vary. Mounts said it has posed a challenge to some vendors who provide software for cash registers in multiple locations.

Tessa White Carr, manager of the Tax Department at the accounting and consulting firm Arnett Foster Toothman, works with a variety of small and large businesses across the state. To be sure all of the paperwork gets filed on time, “It’s always a good idea to map out what is due and when,” she said. “If a business uses a public accounting firm or a consultant, they’ll also assist with some of those filings.”

Carr said it’s helpful to look over the state Tax Department’s 2014 tax calendar, which lists state taxes and deadlines.

New businesses and businesses that have experienced staff turnover or have recently moved are especially susceptible to missing a tax filing, Carr said.

In addition to state taxes, there are federal, county and city reports and tax filings. Some are not well known. Carr said two federal examples are special reporting requirements for those with foreign bank accounts and a fee imposed by the Affordable Care Act on companies with a self-insured health plan.

Once a business gets involved with federal and state tax filings it’s not unusual to receive helpful reminders from various agencies. But seamless integration is an ideal, not a reality.

Earlier this month a company which failed to pay Charleston’s business and occupation tax for a decade paid $3.8 million in back taxes, penalties and interest.

“If you are a new small business owner and have no clue about any of the filings, it’s easy to miss things or not realize so many filings are due,” Carr said. “The 15th, the 20th and the 31st are the big dates each month. Industry specific taxes, such as the health care provider tax, severance tax, fuel tax and alcohol tax, are usually due monthly.

“State and other government entities are not out for you,” she stressed. “If you miss a filing by accident and you’re new and still learning, they’re very understanding and helpful if you call or write a letter.”

Tax deadlines are top-of-mind with accountants like Carr but “it’s probably not as ingrained in the heads of an internal accountant or small-business owner,” she said.

A tip: “Definitely keep all of your documents in one location so it will be easier to find them,” Carr said. “Next year you can figure out what you did at the same time the prior year.”

Carr said businesses can benefit from consulting tax professionals not only to make sure deadlines are met but to learn about available tax breaks.

For example, some manufacturers can plan to take advantage of what’s known as the Freeport Exemption. “If I’m a manufacturer and I have this whole room of goods going out of state and I know exactly where they’re going, I could identify those goods before July 1 and they’re not subject to the property tax,” she said.

Licensed professionals need to be mindful of occupation-specific requirements. Examples:

* Brenda Turley, executive director of the West Virginia Board of Accountancy, said the 2,242 certified public accountants in West Virginia must renew their individual licenses annually by June 30.

Turley said the usual explanations for late filings are: ‘I forgot,’ ‘I didn’t receive the renewal information in the mail,’ ‘I moved so the renewal information did not catch up with me,’ and, ‘I just got busy.’

* State Insurance Commissioner Mike Riley said insurance agencies are required to renew their licenses annually by June 30.

As for individual insurance agents’ licenses, they’re valid for a two-year period and the renewal dates are tied to the agent’s birth month “so we have renewals throughout the year,” Riley said.

Gov. Earl Ray Tomblin said through his spokesman, “In West Virginia, we have worked hard to create a climate where companies are encouraged to innovate, expand and create new jobs. Companies across the globe have noticed the changes we’ve made – cutting taxes, reducing workers’ compensation rates, strengthening our education system and others – and those improvements benefit our entrepreneurs and existing local businesses as well.”