CHARLESTON, W.Va. — A group of business, industry and association leaders gathered in Charleston Wednesday to discuss the Affordable Care Act’s proposed health insurance tax, which, after being delayed by a vote of Congress in 2017, will be implemented automatically in January without another vote by Congress.

The Congressional moratorium on the tax lapses at the end of the year, and, according to Chris Walters of Capitol Insurance Group, West Virginia will be particularly hard hit by the tax, as the state’s insurance costs are already some of the highest in the nation.

Walters and Bridget Lambert, president of the West Virginia Retailers Association; Bill Milam executive director of the West Virginia Association of Retired School Employees; and Phil Shimer of TSG Consulting of Charleston, addressed a gathering at Bridge Road Bistro in Charleston.

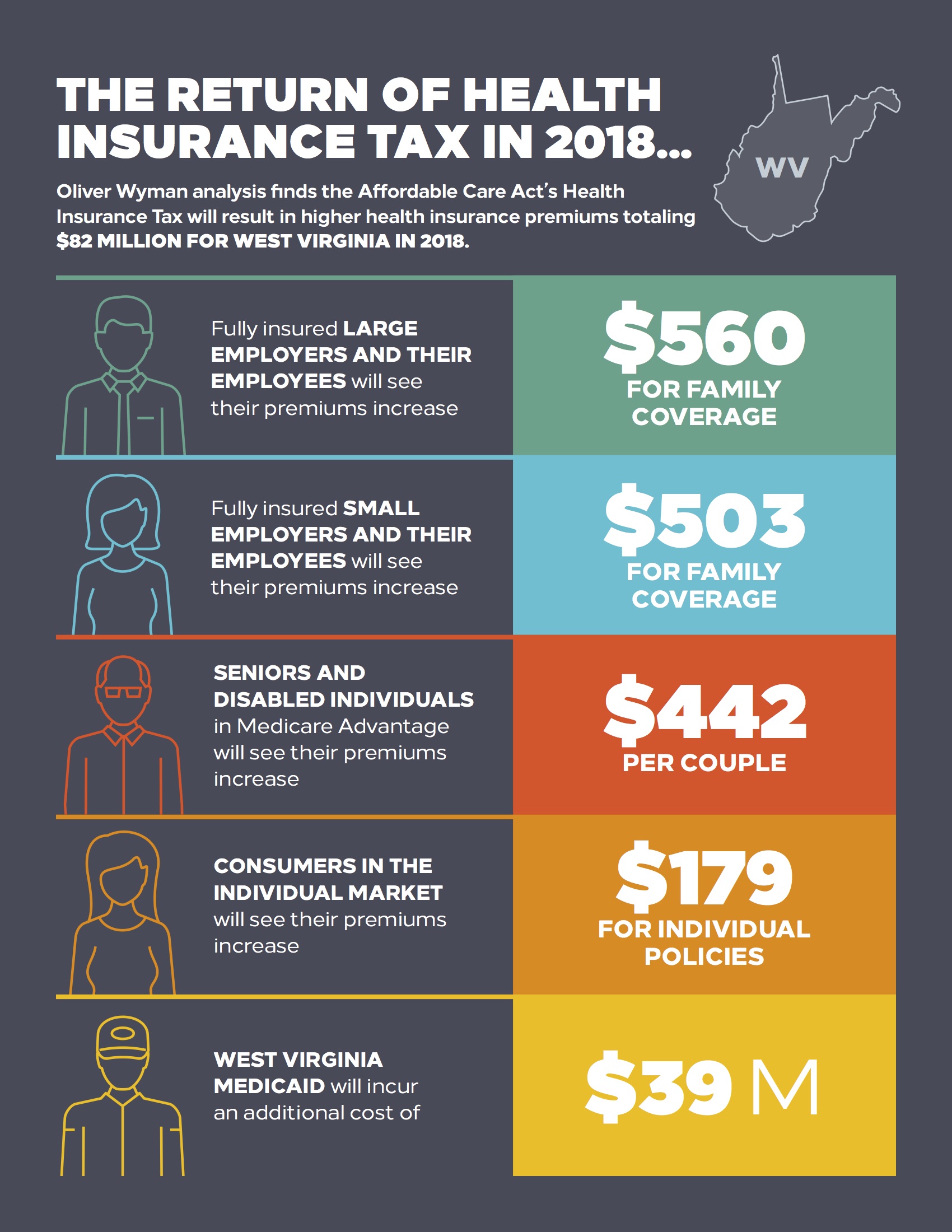

According to the presentation, The Health Insurance Tax (HIT) will:

— increase the cost of a family health insurance policy by $500 a year;

— cost PEIA and its Medicare retirees $360 per year per person or over $20 million per year;

— cost the West Virginia Medicaid program at least $50 million per year.

Organizers of the meeting explained their view of the impact, answered questions and asked that West Virginia’s business and industry associations write to the state’s Congressional delegation requesting the continued suspension or elimination of the health insurance tax.

For more information, visit www.StopTheHIT.com

For more information, visit www.StopTheHIT.com