By GEORGE HOHMANN

West Virginia Press Association

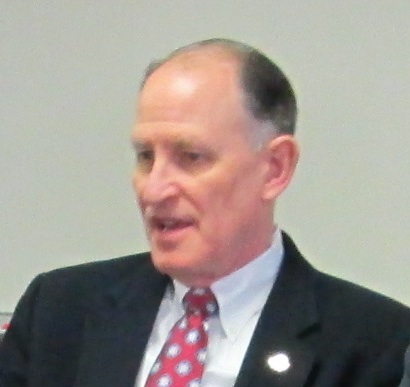

SOUTH CHARLESTON, W.Va. — West Virginia Senate President Jeff Kessler’s push for a state fund that squirrels away some severance tax money for future needs has some industry support, but there’s no agreement on the details.

Kessler’s “Future Fund” idea was among the proposals discussed Monday, Jan. 6, at the Legislative Lookahead sponsored by The Associated Press, the West Virginia Press Association and Marshall University at Marshall’s South Charleston campus.

The proposal is expected to be a major topic of debate when the state Legislature’s 60-day session convenes Wednesday.

“I call the Future Fund ‘The Why Not Fund,’” Kessler said. “What if legislators had not spent every single penny of the severance tax every year?

“If they had set aside just 1 percent of the severance tax starting five years ago, we would have nearly $8 billion. If we were getting 10 percent interest on $8 billion, we would get $800 million a year. We would be halfway there with our highway needs, or teacher pay. We would have $800 million available every year.”

Kessler said his proposal wouldn’t set aside any severance tax money until the tax raised a threshold amount. “I’m not affecting one dollar in this year’s budget,” he said. Kessler further proposed putting a state constitutional amendment on the ballot that would set a procedure for deciding how to use money in the fund.

The Marshall County Democrat took a bipartisan group of legislators to North Dakota in August to learn how that state set up its Legacy Fund. That fund amassed $1.3 billion in 20 months, he said.

“For 70 years, North Dakota lost population each and every year,” Kessler said. “Does that sound familiar? I just read that this past year, West Virginia and Maine were the only two states that actually lost population. Guess what state led the nation in population growth: North Dakota! Why not us, why not now?”

Corky DeMarco, executive director of the West Virginia Oil and Natural Gas Association, said he has no objection to a Future Fund as long as the industry’s taxes aren’t raised. West Virginia’s natural resource extraction industries compete with Pennsylvania, Ohio, Kentucky and New York, he said.

“I think the concept is great,” DeMarco said. “I think we should have been doing this 75 years ago.”

Ted Boettner, executive director of the West Virginia Center for Budget and Policy, said some severance taxes from all non-renewable natural resource industries should go into the fund. The center is a nonpartisan, nonprofit organization funded by labor unions, foundations and others.

“Do we want to be 49th or do we want to be sure we’re building a sustainable economy?” Boettner asked. “We don’t want to repeat the past. That’s why it’s so important we get this right. This (Future Fund) helps us have assets. It can pay out more, the more industries that are included.”

DeMarco said, “To leave one industry out and tax another, I’ll leave that to the folks who run the Senate and House. What I’m concerned about is West Virginia maintaining a competitive advantage and not a disadvantage because of its tax structure.”

Bill Raney, president of the West Virginia Coal Association, said, “We can’t stand an increase in any taxes.

“We’re pleased with the idea of saving taxes,” he said. “I agree we should have done it years ago. We’re challenged right now. We’re challenged with our tax structure – our tax takes us out of the competitive world market.”

Many of the industry’s challenges come from Washington, D.C. and are “out of our control,” Raney said.